how long does coverage normally remain on a limited-pay life policy

As a result premium payments will be higher than if payments were spread out through your lifetime. 10-year Renewable and Convertible Term Life Paid-Up at Age 70 Straight Whole Life Renewable Term to Age 100.

Paying For Life Insurance American Family Insurance

Premiums are payable for 10 15 or 20 years depending on the policy selected.

. These limited pay life insurance policies become paid-up when the insured reaches a number of years or certain age such as to age 65. Which of these would be considered a Limited-Pay Life policy. What kind of life insurance starts out as temporary coverage but can be later modified to come to coverage without evidence of insurability.

You can pay premiums monthly quarterly semi-annually or annually. There are Twenty Year Limited Pay Whole Life policies whereby the death benefit if forever but only 20 annual payments need be made. A limited pay whole life policy is a permanent insurance policy guaranteed to be fully paid-up at a certain date or when you reach a certain age with no more premiums due.

The 20 pay option is an interesting choice and worth consideration. As long as the policy was active at the time of the insured individuals passingthat is. If G were to die at age 50 how long would Gs family receive an income.

Which insurance product can cover his children-Assignment provision. In most cases whole life policies pay a tax-free death benefit to beneficiaries when the insured dies. Single premium whole life insurance.

Term length limits can also impact how much coverage you get regardless of how much life insurance you need and can afford. There is also a Fifteen Year Limited Pay Whole Life option. As a general rule of thumb fewer years results in a higher annual premium.

Also the shorter the pay period the more faster you will accumulate cash value. Typical terms today include a daily benefit of 160 for nursing home coverage a waiting period of about three months before insurance kicks in and a maximum of three years worth of coverage. There is no set termwhole life policies build.

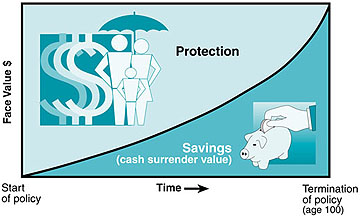

Policies with a predetermined agreed paid-up age or time length are an interesting variation on paid-up whole life insurance. Premiums on limited payment life insurance are paid for a limited number of years but the benefits last a lifetime. Learn More.

Premium payments limited to a specified number of years. With the limited pay life insurance option you pay premiums in the early years of ownership but the benefits. Premiums are payable for as long as there is insurance coverage in force.

Paid Until Age 65. This policy lets you pay premiums for only a specific period such as 20 years or until age 65 but insures you for your whole life. In other words rather than paying your insurance premiums in perpetuity you agree to pay them in full over a pre-specified time.

Older people may be restricted to 10- or 20-year terms especially once they reach their 60s and 70s. A Limited-Pay Life policy has. A Limited-Pay Life policy has.

How long does the coverage normally remain on a limited-pay life policy. Usually a life insurance company will give you a 30 day grace period before your life insurance policy lapses. S is covered by a whole life policy.

There isnt any time limit when it comes to claiming a life insurance payout. Age 100 20 A term life insurance policy matures upon the insureds death during the term of the policy Decks in Insurance Class 3. If you stop paying those premiums your policy will lapse meaning you lose your life insurance coverage and your beneficiaries wont get any life insurance money when you die.

But these stand-alone LTC policies have had a troubled history of premium spikes and insurer losses thanks in part to faulty forecasts by insurers of the amount of care. How long does the coverage normally remain on a limited-pay life policy. How long does the coverage normally remain on a limited-pay life policy.

A basic 50000 life insurance policy could pay funeral expenses and clear a few debts but youll need a larger policy if you want to leave money behind to. You may still be able to reinstate the policy if you sign an affidavit saying that you have not had any material changes in your health. Receiving payment from your life insurance typically involves your beneficiaries filing a claim and then waiting up to 30 to 60.

A policy lapse wont happen immediately after one missed payment. Limited payment whole life insurance. This policy guarantees the benefit forever and yet only has payments for 15 years.

Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years. Convertible term T would like to be assured 10000 is available in 10 years to replace the roof on his house what kind. All life insurance companies have a grace period usually around 30 days which allows your policy to stay in force.

Guaranteed cash value grows tax-deferred. What kind of life policy either pays the face value upon the death of the insured or when the insured reaches age 100. You may have to wait up to 30 days for a payout but you will usually receive it much sooner.

But on average how long does it take for life insurance to be distributed. Reduced paid-up insurance is only available for whole life insurance and not term insurance policies since these plans do not have a cash value. For example a 500k 10 year limited pay whole life insurance policy will cost more than a 500k 20 year policy.

Additionally a life insurance company will usually require three years of premiums before your policy would become eligible for reduced paid-up insurance. Most insurance companies will issue the death benefit within two weeks of the policyholders death. Since it is now more than 30 days late you likely do have a lapsed policy.

That can be anywhere from 20 to 30 years if you plan to support past the age of 18.

How Much Is A 1 Million Life Insurance Policy Who Needs It

Guaranteed Issue Life Insurance Policies Fidelity Life

/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

Variable Life Vs Variable Universal What S The Difference

What Is Whole Life Insurance Cost Types Faqs

2022 Final Expense Insurance Guide Costs For Seniors

How Does Life Insurance Work The Process Overview

/dotdash-090816-cash-value-vs-surrender-value-what-difference-final-b2df392375e34caf9eac4e7bc2648283.jpg)

Cash Value Vs Surrender Value What S The Difference

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Guaranteed Issue Life Insurance Policies Fidelity Life

Guaranteed Issue Life Insurance Policies Fidelity Life

What Is Term Life Insurance Money

Life Insurance Purposes And Basic Policies Mu Extension

Types Of Life Insurance Explained Progressive

Guaranteed Issue Life Insurance Policies Fidelity Life

2022 Final Expense Insurance Guide Costs For Seniors

What Is Limited Pay Life Insurance Paradigm Life Insurance

Health Insurance And Pregnancy 101 Ehealth Insurance