2021 electric car tax credit irs

In 2022 President Bidens Build Back Better infrastructure bill intended to increase the electric car tax credit from 7500 to 12500 for qualifying vehicles but this bill failed. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

Understanding The Electric Vehicle Credit Strategic Finance

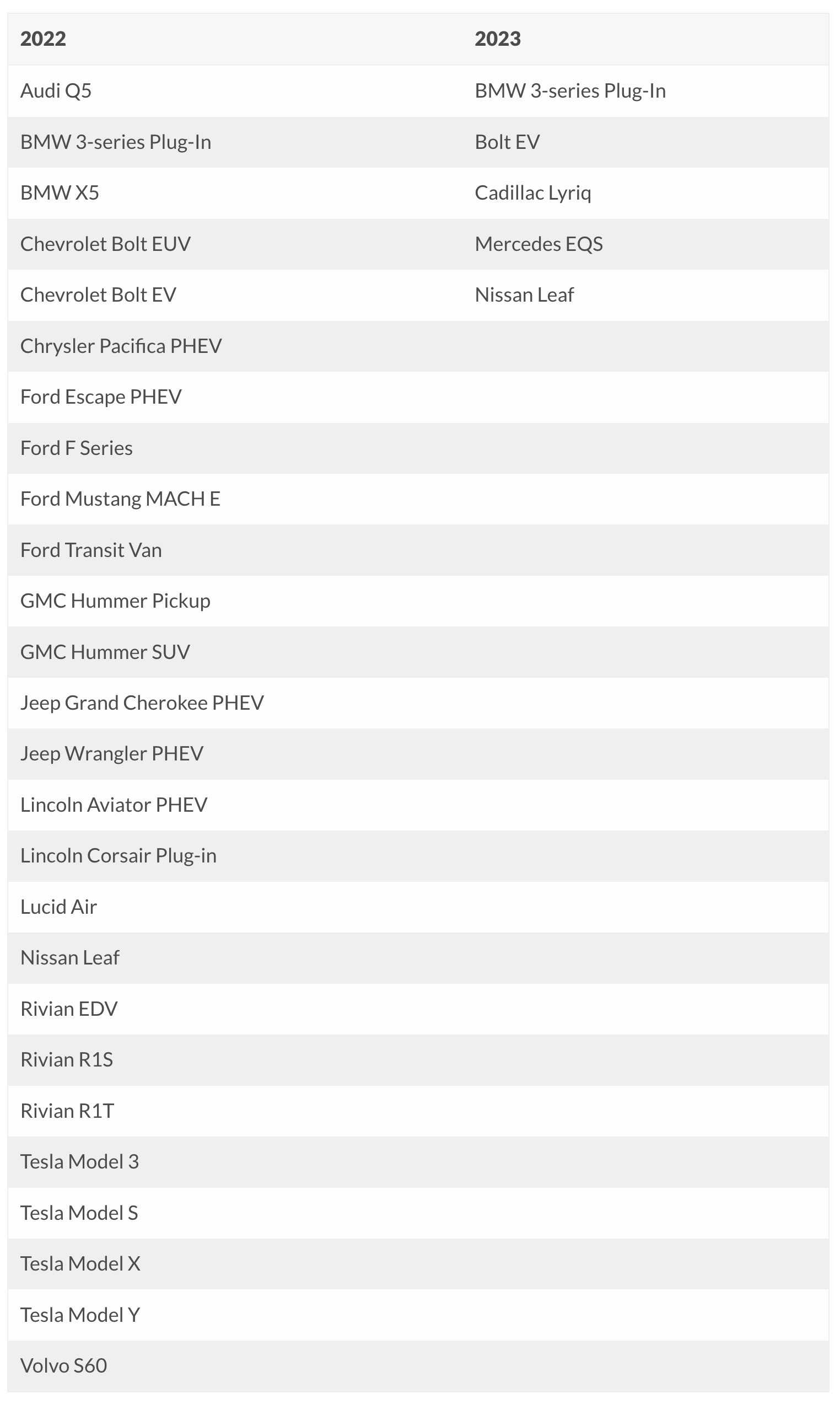

Sales of electric vehicles continues to grow through 2022 and 2023 as more options are given to consumers.

. Notice 201367 Qualified 2- or 3-Wheeled Plug-In Electric Vehicle Credit Under Section 30Dg Notice 2016-15 Updating of Address for Qualified Vehicle Submissions. About Publication 463 Travel Entertainment Gift and Car Expenses. 8864 Biodiesel and Renewable Diesel Fuels Credit.

In August 2021 the US. A tax credit means an EV buyer will receive up to a 7500 reduction in their tax liability for the year. The IRS cant issue refunds before mid-February 2021 for returns that claimed the EIC or the additional child tax credit ACTC.

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market. If you purchased a new all-electric vehicle EV or plug-in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7500 according to the US. Enacted August 16 2022 The Inflation Reduction Act of 2022 Public Law 117-169 amends the Qualified Plug-in Electric Drive Motor Vehicle Credit now known as the Clean Vehicle Credit and adds.

Claim your 7500 credit if you purchased a new electric vehicle EV in 2022. 2023 EV Tax Credit Extending the Electric Clean Vehicle Rebate For New and Used Cars. Download the official IRS2Go app to your mobile device to check your refund status.

All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500. Currently a few foreign nameplate automakers build EVs in North America. 17 states weigh adopting Californias electric car mandate.

You qualify for the Earned Income Tax Credit EITC You may not have filed a tax return because your wages were below the filing requirement. But has recently moved to Chattanooga Tennessee. So if tax filers with joint returns use the amounts provided in the letters to figure out how much to claim on their 2021 tax return it would have been flagged and likely delayed their refund payment further.

6478 Biofuel Producer Credit. Call the automated refund hotline at 800-829. 2021 Panamera 4 PHEV 4 E-Hybrid 4 E-Hybrid Sport Turismo 4 S E-Hybrid 4 S E.

Production of the Volkswagen ID4 was started outside of the US. A Microsoft 365 subscription offers an ad-free interface custom domains enhanced security options the full desktop version of Office and 1. The Nissan Leaf is made in Symrna Tennessee and the Volvo S60 Recharge is produced in South Carolina.

Claiming the Federal Tax Credit. Changing its use to business use doesnt qualify the cost of your car for a section 179 deduction in 2021. It would also limit the income of buyers.

The Fed Continues to Raise Rates in. The section is a provision for the Qualified Plug-In Electric Drive Vehicle tax credit first provided for by the Energy Improvement and Extension Act of 2008. In 2020 you bought a new car and used it for personal purposes.

The upshot of all this is that a car must have at least an 18 kWh battery to qualify for the full tax credit. In the long term the new EV incentives may present a significant improvement over the existing tax credit system and help middle-class Americans afford EVs. Weve developed a suite of premium Outlook features for people with advanced email and calendar needs.

Imagine getting a bunch of tax documents telling you and the IRS about a large sum of money you made when in fact you never. You can get a 7500 tax credit to buy an electric car but its really complicated. 4136 Credit for Federal Tax Paid on Fuels.

Among the myriad provisions in the 755-page bill are changes to the electric vehicle Federal tax credit of 7500. The IRS also says the credit is only available for the purchase or lease of a vehicle. The US Senate has passed the Inflation Reduction Act with nearly 400 billion in funding over 10 years for climate- and energy-related programs.

Corporations to 21 percent and calculate it on a country-by-country basis so it hits profits in tax havens. The IRS has been diligently introducing and maintaining tax credits to promote energy efficiency since 2008 when it added Section 30D to the Internal Revenue Code IRC. Department of EnergyThe total federal incentive amount depends on the capacity of the battery used to power your car and state andor local incentives may also apply.

Federal Tax Credit Up To 7500. The Presidents tax reform proposal will increase the minimum tax on US. A new federal electric car tax credit program is set to go.

The IRS will rely on a cars vehicle identification number or. See Depreciation Deduction later. For information about your state tax refund check contact your state revenue department.

The bill renews the credit starting in January 2023 and carries it through until the end of 2032. If an EV buyer has a tax bill of say 3000 at the end of the year the EV tax. Senate approved a nonbinding resolution to set a 40000 limit on the price of electric cars eligible for the current tax credit.

This applies to the entire refund not just the portion associated with these credits. The Qualified Plug-In Electric Drive Motor Vehicle Credit can be worth up to 7500 in nonrefundable credit. But you can still file a return within three years of the filing deadline to get your refund.

Thats because to be eligible for a credit new electric vans SUVs or pickup trucks cant cost more than 80000 while the price of other types of vehicles cant exceed 55000. 2021 and the day before the enactment of the act to file for the maximum 7500 federal tax credit available for electric cars of. But this is a flat credit which means it is only worth the full 7500 if the individuals tax bill is at least 7500.

In 2021 you began to use it for business. However you can claim a depreciation deduction for the business use of the car starting in 2021. It applies to plug-in hybrid vehicles or PHEVs and plug-in electric vehicles EVs or PEVs.

Notice 2009-89 New Qualified Plug-in Electric Drive Motor Vehicle Credit. 6197 Gas Guzzler Tax. President Bidens climate and health care bill revamps a tax credit available for buyers of electric.

8849 Claim for Refund of Excise Taxes and Schedules 13 5 6 and 8. Updated information for consumers as of August 16 2022 Qualified Plug-In Electric Drive Motor Vehicles IRC 30D Internal Revenue Code Section 30D provides a credit for Qualified Plug-in Electric Drive Motor Vehicles including passenger vehicles and light trucks. The hybrid tax credit is the same credit as the EV tax credit for your IRS return.

Key Points of the Hybrid and EV Tax Credit. The credit amount will vary based on the capacity of the battery used to power the vehicle.

Irs Lays Out How To Get Tax Credits For Purchasing Electric Vehicles

Here S Every Electric Vehicle That Qualifies For The Current And Upcoming Us Federal Tax Credit Electrek

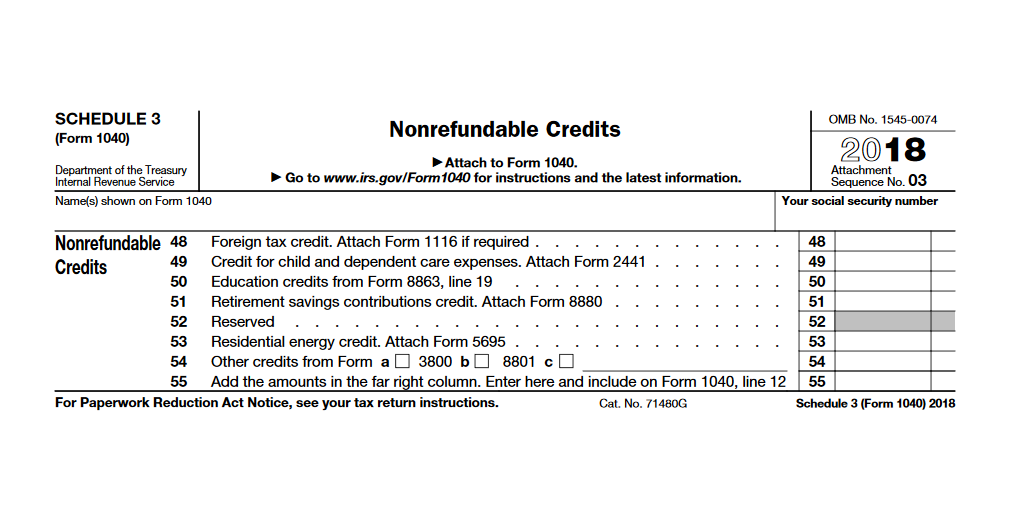

Irs Schedule 3 Find 5 Big Tax Breaks Here

Electric Vehicle Tax Credits On Irs Form 8936 Youtube

The Irs Wants To Change The Crypto Question On Tax Returns Again

Irs List Of Qualified Electric Vehicles Best Sale 57 Off Www Ingeniovirtual Com

The Irs Is In Crisis Taxpayer Advocate Warns Of 2022 Refund Delays

Irs List Of Qualified Electric Vehicles Best Sale 57 Off Www Ingeniovirtual Com

1040sr For Seniors Step By Step Walkthrough Of Senior Tax Return 1040sr New Irs Form 1040 Sr Youtube Irs Forms Irs Tax Return

Gift Electric Car To Spouse Get Tax Credit Internal Revenue Code Simplified

Irs List Of Qualified Electric Vehicles Best Sale 57 Off Www Ingeniovirtual Com

The Irs Is In No Position To Do Your Taxes The Hill

Irs List Of Qualified Electric Vehicles Best Sale 57 Off Www Ingeniovirtual Com

How The Federal Ev Tax Credit Amount Is Calculated For Each Ev Evadoption

Doe And Irs Issues List Of Ev Vehicles That May Now Be Eligible For Tax Credits Is There Anything Here You Even Want Autospies Auto News

/ScreenShot2021-02-08at3.59.40PM-9f028cea3cb545d19e4c64e10ca68a06.png)

Form 8962 Premium Tax Credit Definition

Irs Fails To Stop Electric Car Tax Credit Cheats

Irs Tax Tracker How Long Does It Take For Irs To Approve Refund Marca